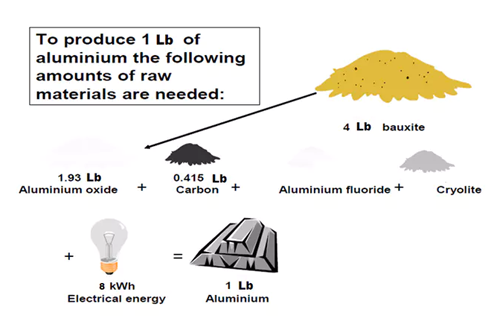

Alumina is a key input in aluminum’s production process. It can take almost two pounds of alumina to produce one pound of aluminum, as you can see in the above graph.

Alumina prices

Alumina prices impact aluminum companies. But first, let’s look at aluminum’s value chain. It begins with mining bauxite, one of the most abundant metals in the Earth’s crust. Because of bauxite’s many impurities, it must be refined to produce alumina. Alumina is then processed to produce raw aluminum.

Companies such as Rio Tinto (RIO), Norsk Hydro (NHYDY), and Alcoa (AA) have alumina refining as well as aluminum smelting operations. However, Century Aluminum (CENX) produces aluminum by sourcing alumina from outside parties.

Key input

Alumina is a key input in aluminum’s production process. It can take almost two pounds of alumina to produce one pound of aluminum, as you can see in the above graph. Naturally, changes in alumina prices would impact aluminum’s production costs.

Alumina doesn’t have a very liquid market, and that makes pricing it difficult. Aluminum, on the other hand, is the most widely traded metal on the LME (London Metal Exchange). As a result, most alumina producers used to price their products at a percentage of aluminum prices. However, over the last few years, several aluminum companies have been gradually moving to the alumina price index (or API). Alumina prices through API are less dependent on aluminum prices and help in independent price discovery of alumina.

In the next part, we’ll explore the recent trend in alumina prices and how they impact Alcoa and Century Aluminum.

Investors looking at direct exposure to base metals can consider the PowerShares DB Base Metals ETF (DBB). DBB invests a third of its holdings in aluminum.