The alumina price index (or API) is currently hovering around $250 per metric ton. Alumina was largely flat in May with little downward price action.

Aluminum and alumina prices

The alumina price index (or API) is currently hovering around $250 per metric ton. Alumina was largely flat in May with little downward price action. However, for four consecutive months prior to May, API closed up. API has gained more than $50 per metric ton, or ~25%, since the beginning of the year. However, LME (London Metal Exchange) aluminum prices have risen only about 3% year-to-date. Let’s see what’s driving this divergence between alumina and aluminum prices.

Divergence

It’s worth noting that higher API prices are positive for companies that sell alumina. Alcoa (AA), RIO Tinto (RIO), and Norsk Hydro (NHYDY) sell alumina along with primary aluminum. However, Century Aluminum (CENX) buys alumina from third parties and is naturally negatively impacted if API rises more than LME aluminum prices.

API

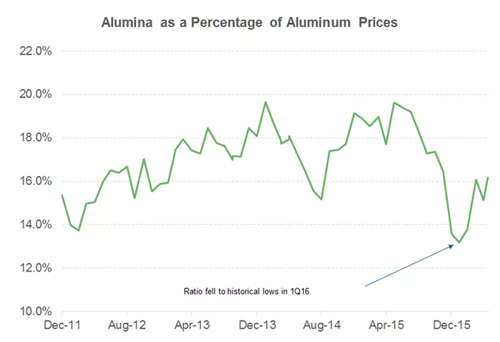

Alumina prices as a percentage of LME aluminum prices fell to a low of 13.1% during 1Q16. This is almost four percentage points below the average ratio since December 2011 when API was launched by Metal Bulletin.

As we saw in the previous part of this series, alumina prices through API are less dependent on aluminum prices and help in the independent price discovery of alumina. Nonetheless, alumina prices can’t be totally independent of aluminum prices. This is similar to the steel industry (XME), where iron ore and steel prices have a close correlation.

Because alumina as a percentage of aluminum prices has fallen to lower levels, it warranted a reversion. As a result, we saw alumina actually outperform aluminum prices this year. Currently, API as a percentage of aluminum is in the ballpark of 16%, which is close to the long-term average.