Analysts predict that the opportunity in the global synthetic diamonds market will be worth US$28.83 bn by 2023 as against US$15.73 bn in 2014. Between 2015 and 2023, the overall market is expected to progress at a CAGR of 7.0%. The demand...

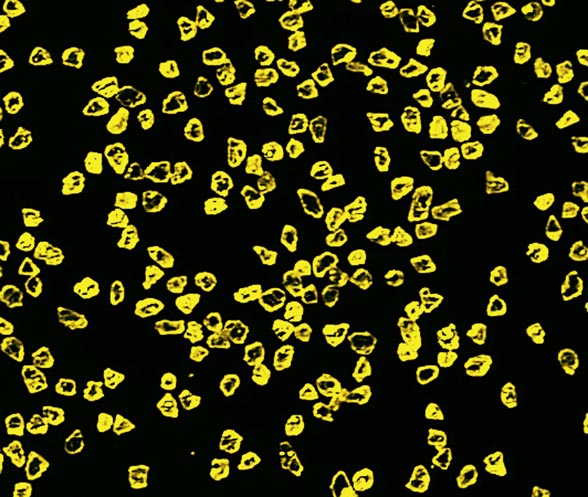

The peculiar characteristics of synthetic diamonds such as high mechanical strength and low toxicity have increased its utility across a wide range of industrial applications in the recent years. Currently, synthetic diamonds are used in machinery production, construction, chip production, mining activities, and oil and gas exploration amongst others. The ability of these diamonds to weather harsh conditions is one of the key reasons supporting their growing importance in a wide range of industrial activities. Furthermore, the affordability of synthetic diamonds over naturally mined diamonds has also propelled the sales of the synthetic products.

Analysts predict that the opportunity in the global synthetic diamonds market will be worth US$28.83 bn by 2023 as against US$15.73 bn in 2014. Between 2015 and 2023, the overall market is expected to progress at a CAGR of 7.0%. The demand for synthetic diamonds will also increase due to their increasing adoption in jewelry making. Availability of colorful synthetic diamonds is adding aesthetic value to jewelry as well as improving the affordability of these ornamental items. Currently, synthetic diamonds hold 1% share in the global diamond jewelry market, which is expected to increase due to the increasing research and development to deliver improved products in the near future. However, the time-consuming process of making synthetic diamonds is likely to hamper the growth of this market in the coming years.

The two types of diamonds available in the global synthetic diamond market are polished and rough. The rough synthetic diamond accounted for a share of 98.8% in the overall market as of 2014, while polished diamond held a meager share of 1.2% in the same year. The demand for polished synthetic diamonds in jewelry will continue to remain sluggish all throughout the forecast period. On the other hand, the rough synthetic diamond segment will surge at an impressive CAGR of 6.8% between 2015 and 2023. The primary growth driver for this segment will be the increasing usage of rough diamonds in sectors such as healthcare, electronics, and construction amongst others.

In terms of revenue, the Asia Pacific synthetic diamond market is expected to expand at a CAGR of 7.7% between 2015 and 2023. The growing demand for jewelry and the increasing usage of synthetic diamonds in making jewelry will be the prime growth driver for this regional market. The robust pace of industrialization and increasing construction activities in Asia Pacific will also be responsible for the growth of this market in this specific region. Additionally, as leading players are setting up manufacturing units in emerging economies of China and India, this move too, will contribute generously towards the progress of this regional market.

The key companies operating in the global synthetic diamond market Applied Diamond Inc., Pure Grown Diamonds, Element Six, New Diamond Technology, LLC, Scio Diamond Technology Corporation, Washington Diamonds Corporation, and ILJIN. The consolidated competitive landscape of this market is being led by forward integration of business by top players. In the coming years, overcoming the challenge of manufacturing large-sized synthetic diamonds with desired specific will prove to be a game-changer for the players.