The company’s 3Q16 earnings were negatively impacted due to higher alumina (aluminium oxide) costs. Century Aluminum produces aluminum by sourcing alumina from outside parties.

Aluminum stocks’ 3Q16 profits

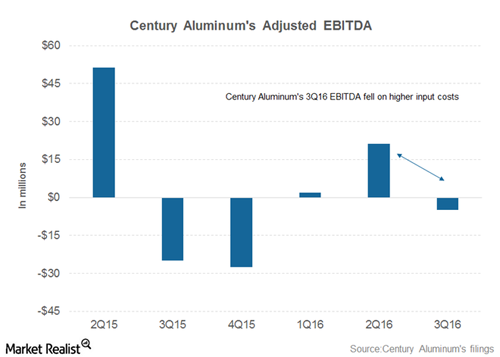

In the preceding parts of this series, we looked at aluminum stocks’ 3Q16 production profiles. In addition to production, it’s also important to follow profitability metrics. We should remember that while net profit is widely used to measure a company’s profitability, for companies in the commodities space (XLB), EBITDA (earnings before interest, tax, depreciation, and amortization) is generally used.

Century Aluminum

Century Aluminum (CENX) generated an adjusted EBITDA of -$5 million in 3Q16. To put this in context, the company posted adjusted EBITDA of $21 million in 2Q16 and -$25 million in 3Q15. The company’s 3Q16 earnings were negatively impacted due to higher alumina (aluminium oxide) costs. Century Aluminum produces aluminum by sourcing alumina from outside parties. As a result, Century Aluminum’s profitability tends to fall when alumina prices rise.

Electricity is another key raw material that goes into aluminum production (RIO). Century Aluminum doesn’t have power generation capacity and sources electricity from third parties, mostly at market-linked prices. According to Century Aluminum, “the third quarter financial performance was negatively influenced by elevated power prices in the US Midwest, a result of the historically hot summer weather.”

Alcoa

Alcoa’s (AA) upstream business generated adjusted EBITDA of $318 million in 3Q16. The segment had generated an adjusted EBITDA of $358 million in 2Q16 and $379 million in 3Q15. Norsk Hydro’s (NHYDY) underlying EBIT (earnings before interest and tax) was 1.37 billion Danish krone (~$160 million) in 3Q16, as compared to 1.6 billion krone (~$188 million) in 3Q16. The company’s 3Q16 earnings were negatively impacted due to adverse currency movements—especially the strengthening of the Brazilian real.