Australia can capitalize on graphite if it considers new technologies that convert it to synthetic diamonds and for use in creating carbon fibers.

Australia can capitalize on graphite if it considers new technologies that convert it to synthetic diamonds and for use in creating carbon fibers, rather than just mining the mineral.

Global demand for graphite was estimated by the U.S. Geological Survey to be around 1250 kilotons in 2014 but could triple by 2035., with the largest growth occurring in its heavy use in lithium ion batteries. Tesla motors massive investment in this technology for domestic home energy storage may provide a major boost to the market. The "gigafactory" being built by Tesla in the US state of Nevada is expected to raise global graphite demand by 30%.

Australian companies have been proactive in anticipating graphite demand growth and there are now several ASX-listed mining firms with graphite ambitions. The New South Wales government has even noted graphite in its prospectus document on industrial mineral opportunities.. At present there is only one functional graphite mine in Australia, the Uley graphite mine on the Eyre peninsula run by Valence Industries. At least 8 other ASX listed companies are known to be exploring for graphite.

The supply of graphite from mined sources is not well-understood due to lack of exploration and geo-science investment in this arena. However, a more integrative approach that considers synthetic sources as well as mining is needed to harness the full potential of graphite.

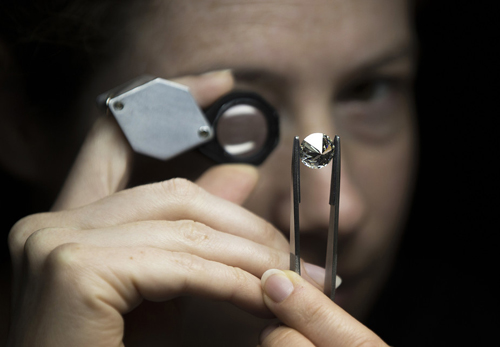

More than seven decades ago, scientists at General Electric devised a process to convert graphite to industrial quality diamonds using very high pressures and temperatures. These diamonds were not of the quality for an engagement ring but worked very well on the edge of cutting saws as "superabrasives." Stanford researchers have since been working on even easier means of converting graphite to diamonds through catalysts. Most diamonds used now in industry are synthetic.

Although these diamonds are unlikely to be in demand in the jewellery retail sector any time soon, their prominence could grow for industrial uses. A subsidiary company of international diamond miner De Beers, called Element 6, has been working on a range of high technology uses of industrial diamonds, such as infra red sensors and radiation detectors. This will spark more interest from businesses in this sector.

However, there is potential to convert coal to graphite and its related nanotechnology material "graphene," for use in greener energy technologies. The technology to accomplish this exists but needs to be made far more cost effective and energy-efficient. Graphene use, like diamonds, by volume will be small as well, though of high importance in terms of its use in strategically important technologies. The large volume uses of graphite would come from demand growth for large structural uses in batteries, buildings and vessels.

Finding better ways of converting coal to graphite for making carbon fibers and other products, could also lead to innovations that make the material more recyclable as well. This goes towards realizing the goals of what the World Economic Forum has called "A Circular Economy."This is when materials cycle back through the production and manufacturing processes. Metals that are traditionally used in large structures corrode over time, whereas carbon fibers have much less propensity for such corrosion and hence have a life cycle more conducive to recycling.